Quantitative Literacy (ELO Quantitative Literacy) - Retirement Planning

Ric Elias had a front-row seat on Flight 1549, the plane that crash-landed in the Hudson River in New York in January 2009. What went through his mind as the doomed plane went down? At TED, he tells his story publicly for the first time.

The message of this video has to do with right now...what you are doing right now...and how it matters right now and it matters in the future.

This assignment has to do with retirement planning...which matters right now and it will matter in the future.

Learning Outcomes

Upon completion of this lesson's material, students will be able to:

- Identify current and future income expectations.

- Identify expenses that will continue after they have retired.

- Complete a form to determine life expectancy for planning purposes.

- Identify the amount of money they will need to save in order to meet expenses at retirement.

- Identify the amount of money they will need to save now, until retirement, to meet this goal.

Teaching

We have a tendancy to not think too much about the future when we are young. It can seem far away and less important than the things that are happening around us right now. We do, however, often harbor a belief that the future will work out well. However, unless we have a PLAN and execute that plan for the future, it may not work out.

In this assignment you are going to be asked to take a very realistic and sobering (maybe) look at your personal finances and retirement planning. The purpose of this assignment is to engage in a process of evaluating personal planning for retirement. In relation to Sociology, we are learning that traditional retirement options such as pensions and even Social Security are increasingly insecure. Financial planning is a critical aspect of successful life management.

Because of the personal nature of this assignment, students will work independently. Your instructor will provide you with a demonstration of each step in the process during the teaching.

No aspect of this assignment will be “handed in” or “graded”…this is for student enrichment. However, we will share our experiences (as much information as you are willing to share) in class or in a discussion.

Step 1

We are going to be using an online retirement calculator to play around with different numbers related to your retirement planning. But before you go to that online calculator, you are going to have to prepare answers to a number of questions. Have these answers ready so you can enter them into the online retirement calculator.

- Your current age.

- The age you want to be when you retire. (example - 65)

- Your current household income (you can also enter your ANTICIPATED household income when you are in your new job after school).

- Your "Annual Retirement Savings" goal...this is the PERCENTAGE of your pay that you want to commit to a retirement plan. (example - 10% of every check)

- Expected Income Increase - this is your expectation for annual increases in income across your career. (2% is a good figure to put in here.)

- Current Total Savings - this represents the total amount of money you have set aside RIGHT NOW for retirement.

- % Income Required - See below

- Years of Retirement - See below

Step 2

Calculating the "% Income Required"

This figure represents what you think your bills are going to be like the year you retire. You can base it on your current budget. Consider the following monthly expenses:

__________ Shelter (rent or mortgage)

__________ Food

__________ Health Care

__________ Clothing

__________ Utilities

__________ Transportation (car, insurance, gas)

__________ Other (recreation, TV, phones, etc.)

Ask yourself, "What percentage of my current income goes to pay these expenses?"

If you anticipate that these will be pretty much the same when you retire you can enter that %. If you believe that your expenses will be lower (mortgage will be paid off, less driving, etc.) then you can adjust it.

This is how much of your future incom is going to go toward expenses.

Step 3

Calculating your "Years of Retirement"

The number of years you need to collect on your retirement is equal to the number of years between when you retire and when you die. So, to help you estimate when you are going to die (I know, a morbid exercise) I have included the attached file.

Complete this file and determine the age you are going to die. Once you know that, subtract from that number the age you want to retire and you have a figure that represents how many years you will need to collect your retirment.

Step 4

Complete the fields in the Online Retirement Calculator

Feel free to change the figures to see how changes in the amount you set aside changes your retirement picture and if you have enough set aside to not run out of money.

HERE IS AN EXAMPLE

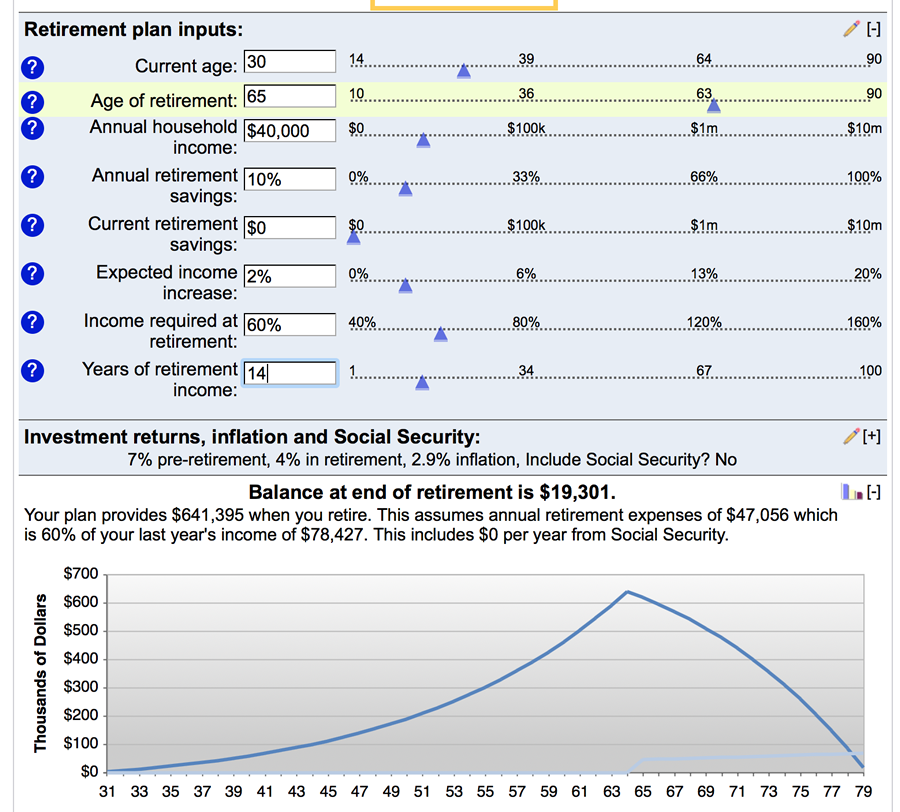

| Age | 30 |

| Age of Retirement | 65 |

| Current Household Income | $40,000 |

| Annual Retirement Savings (% of each check sent to retirement account) | 10% |

| Expected Income Increase | 2% |

| Current Total Savings | $0 |

| % Income Required - based on worksheet that indicates that 50% of my income will go to basic expenses...and I want some extra. | 60% |

| Years of Retirement - based on an anticipated lifespan to 79 years old...79 (age of death) - 65 (age of retirement) = 14 years | 14 |

Below you will see a screen shot from the actual website with this information in it.

According to this plan...

At age 65, I would retir with $641,395 in the bank.

I could withdraw $47,427 per year from this account until my death at age 79

At that point, I will leave a balance of $19,301 still in my account.

Your local bank institutions can help you put a plan like this into place and help you plan for a very secure future!

Assessment

Discuss these results with your family and consider making changes in your planning strategy if needed.